The Nonlinear Economy

Most of us are playing a game that no longer exists.

There are many ways to understand the present and think about the future. Every day, a new invention or product promises to "change everything." But we can't change our plans every day. And some of us have to design systems and products that will only reach the market in a few years — and are expected to remain useful for decades. We also have to make choices about our own lives: What to study, what to invest in, where to live, which leaders to follow, and what companies to join.

In an environment with so much uncertainty, the most dangerous things are answers. Every answer is a bet, and each of those bets is very likely to be wrong. But if we can't rely on answers, what should we rely on?

I like to understand what's going on. Think of a roulette table at a casino. Can you guess the next number or color? No. Can anyone? No. Is there a system that can increase your odds? Strictly speaking, no. Does that mean there's nothing you can do? No.

There is plenty you can do. To start with, you can understand what kind of game you're playing. Then, you can figure out what you're willing to risk (and whether you want to play at all). Then, you can size your bets in a way that gives you multiple opportunities to win. Or pool your bets with other people. Or build a separate business on the side. Or, at least, figure out when to walk away. Or pick a European rather than American table, as their odds vary. Or avoid the game entirely — if you can.

The point is that even without answers, understanding the game can make a critical difference.

So what game are we playing?

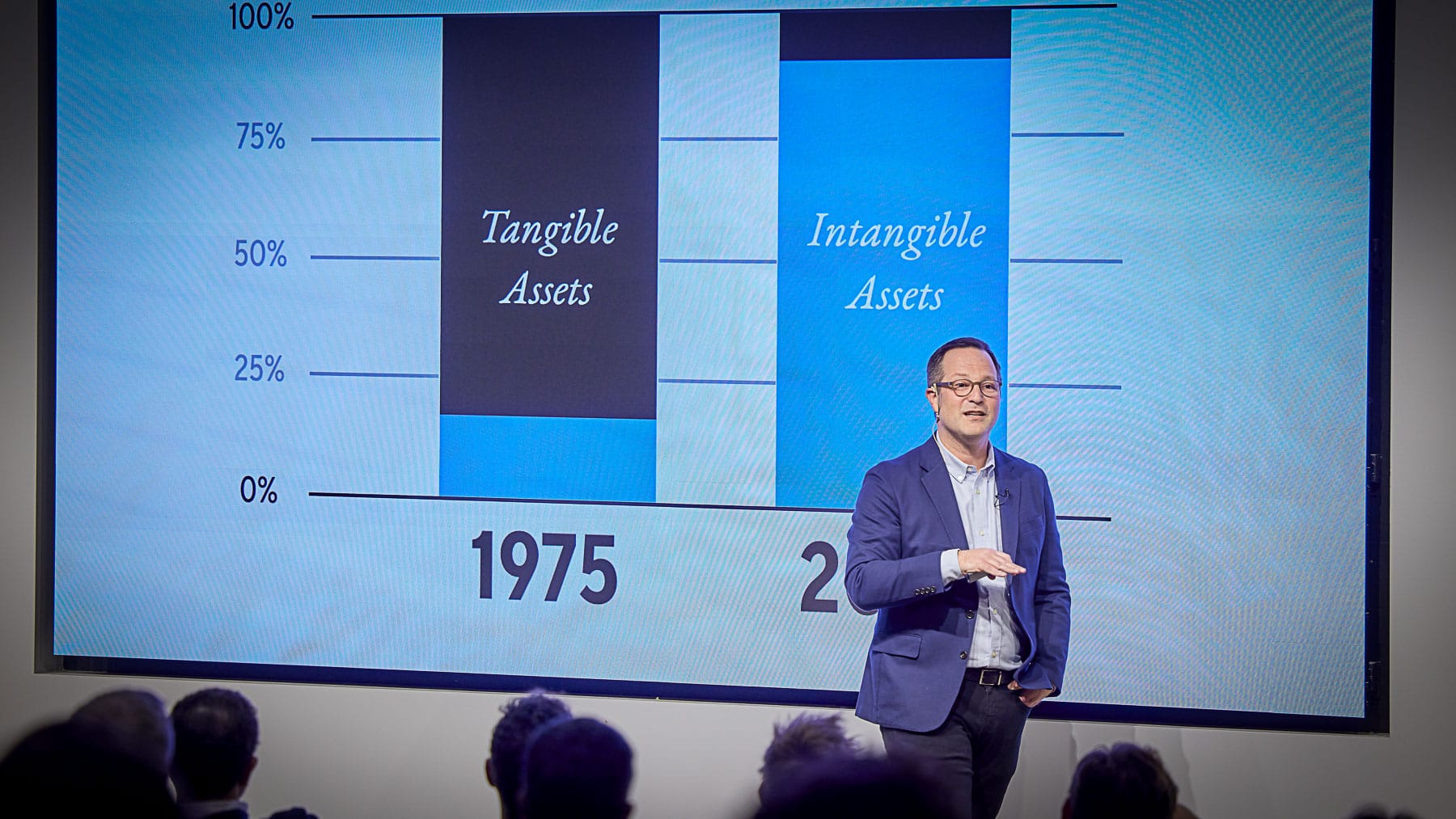

My thesis about the world is quite simple. There has been a fundamental change in the nature of our economy. Fifty years ago, most businesses dealt with physical things. 90% of the assets on the S&P500 balance sheets were tangible assets like car parts, soap bars, and raw materials. Today, the opposite is true: Around 90% of the assets are intangible things like intellectual property, code, content, relationships, and knowledge.

Part of this story is the growth of technology and finance — two sectors that produce ideas (or make money from air) rather than things. But a more important part of the story is the value and utility of even the most physical things — from Tesla cars to Marriott hotels to military drone swarms — are determined by intangible assets like software and stories.

Why did this happen? It's a long story, which I will leave to another time. But what matters is that it happened: We already live in a completely (truly, completely) different economy than the one our parents lived in. We are playing a completely different game. And yet, we insist on playing by the old rules, rely on old assumptions, and maintain physical structures and mindsets that are no longer fit for purpose.

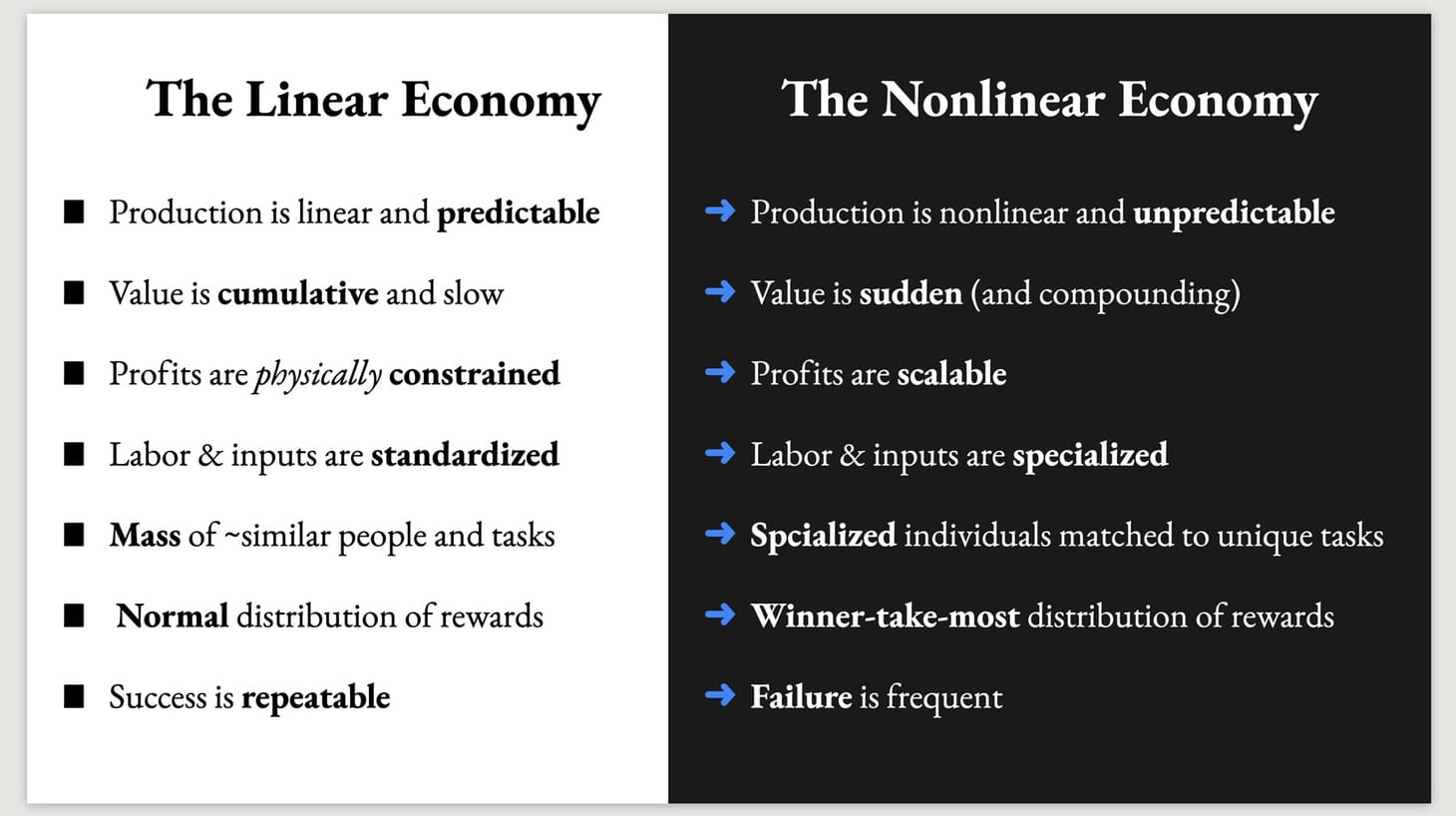

Our economy does not just produce different things; it produces things differently. Producing software and content and ideas is more akin to producing a hit song than to producing a bar of soap or an automobile. The production process of intangible assets is nonlinear: unpredictable, disproportionate, and volatile. The same inputs and efforts can produce wildly different outcomes. The same recipes produce different results. This is true for both production and marketing: In the 20th Century, both of these functions were linear: What you put in had a big impact on what came out on the other side. There were still surprises and competitors, but the range of outcomes was contained, and there was a discernible relationship between effort and reward, quality and value, input and output.

Linear production still matters in many fields: Soap bars and automobiles are still made of known quantities and repeatable processes. But the value and utility of these products depend on intangibles like brand, software, and social networks. As a result, our economy's center of gravity has shifted from linear to nonlinear production. Fifty years ago, nonlinear dynamics were constrained to a few tiny industries like show business and semiconductors. Today, all business is governed by extreme uncertainty, lack of proportion, and volatility.

There is a mismatch between our economy and the world we built around it. Our cities, companies, and management methods were shaped by linear assumptions. They were shaped by answers that are no longer true and by the constant pursuit of new answers that will likely be wrong as well.

We are in a new game. Does it mean we are helpless? Not at all. We can design systems and employ assumptions that embrace uncertainty. Such systems are already powering some of the most successful companies and products of our era — from TikTok's addictive media platform to Medallion's money-printing trading strategies to the way ChatGPT and Nvidia GPUs process information.

I expanded on this in my London talk last week and will talk more about it in my New York talk next week. I will share the recordings and summaries of both once they are ready. And I am writing a whole book on how to navigate this new game. Stay tuned.

🎤 How will AI reshape our cities, companies, and careers? My speaking schedule for the spring and summer is filling up. Visit my speaker profile and get in touch to learn more.

Old/New by Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.