Remote Banking Crisis

Banks tried to kill remote work. Now, remote work is trying to kill banks.

The audio version of this article is available on Spotify, Apple Podcasts, and beyond.

In 2021, banks tried to kill remote work. Goldman Sachs's David Solomon called it "an aberration that we are going to correct as quickly as possible." JP Morgan's Jamie Dimon declared he's canceling all his Zoom meetings and expected the office to "look just like it did before" by October (2021).

In 2023, remote work is threatening to kill banks. Days after the collapse of Silicon Valley Bank, some media reports suggested remote work was to blame. The Financial Times reported:

When Silicon Valley Bank imploded last week, most of its 8,500 staff were still working remotely... Integrating the businesses and pushing into new lines of work such as underwriting tech listings while the bank was working almost entirely remotely caused problems, according to people involved in the acquisitions.

This excuse held up for about five minutes when other banks started showing signs of stress.

And yet, remote work did contribute to the tremors in the banking sector. It didn't do it by weakening banks' internal controls; it did so by destroying the assets on their balance sheets.

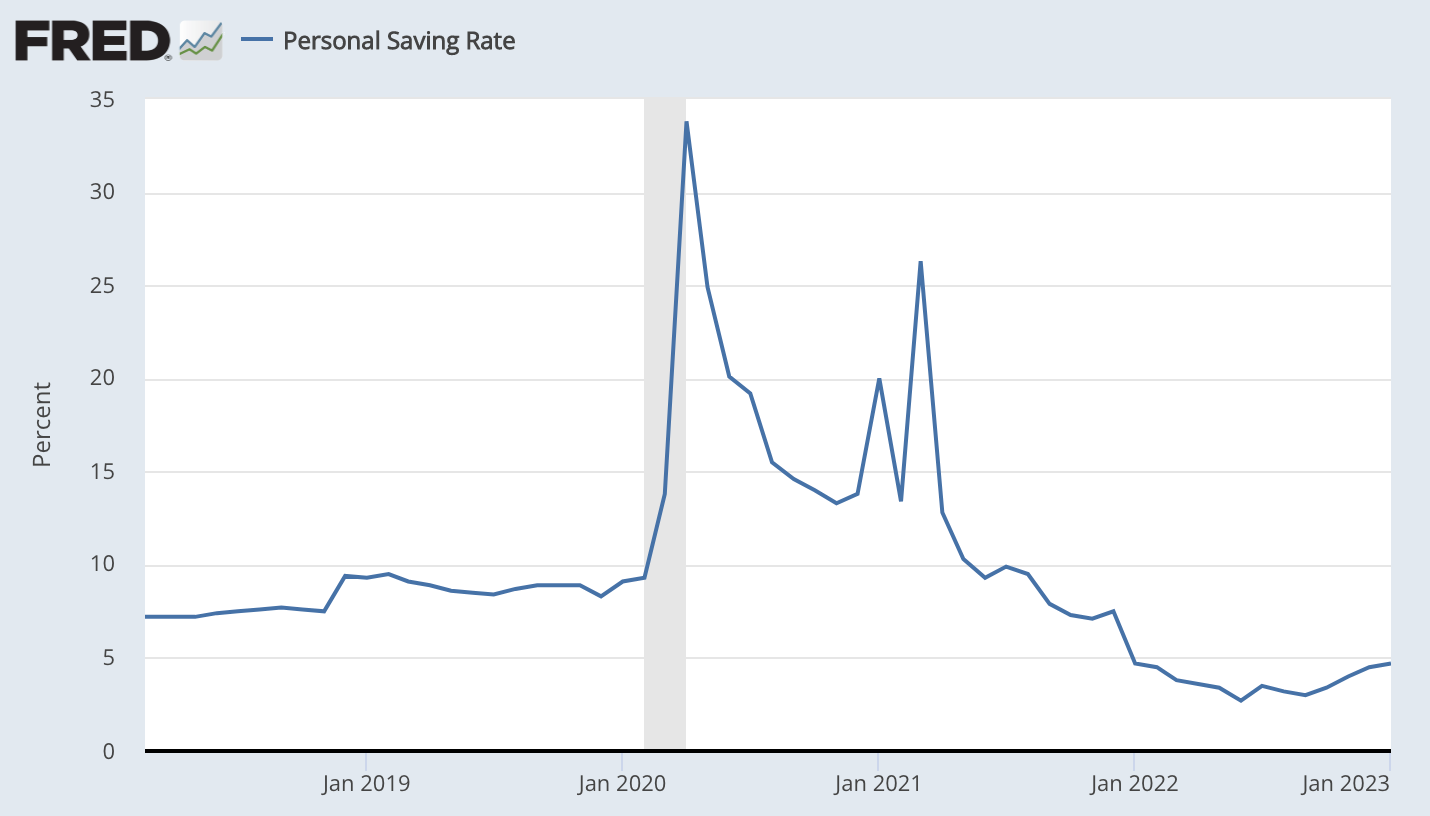

In 2020 and 2021, bank savings increased because people got stimulus checks, tech salaries exploded, and there was nothing to spend on. The glut of new savings meant banks struggled to lend as much money as they took in. Banks are incentivized to put the money to work, and their profitability erodes if they don't.

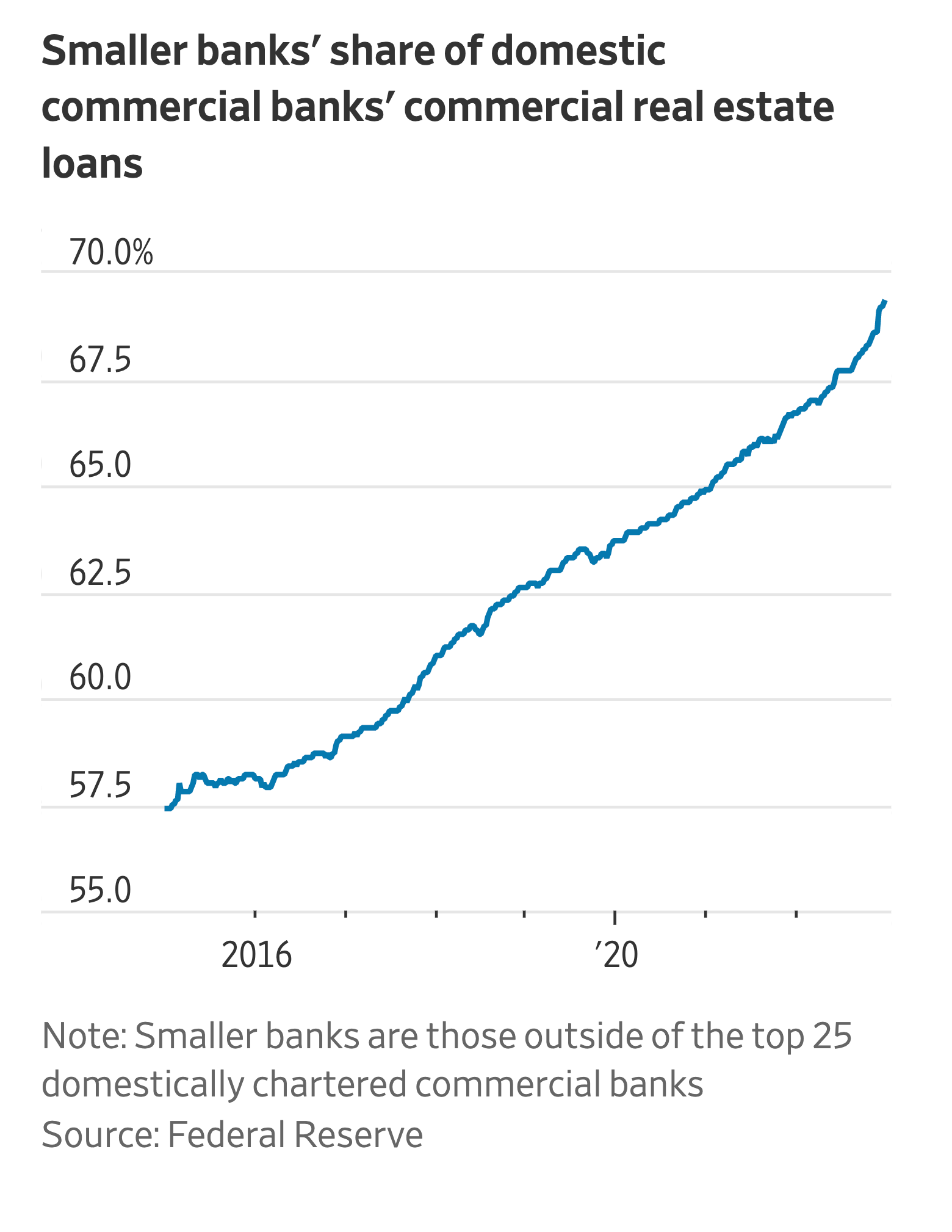

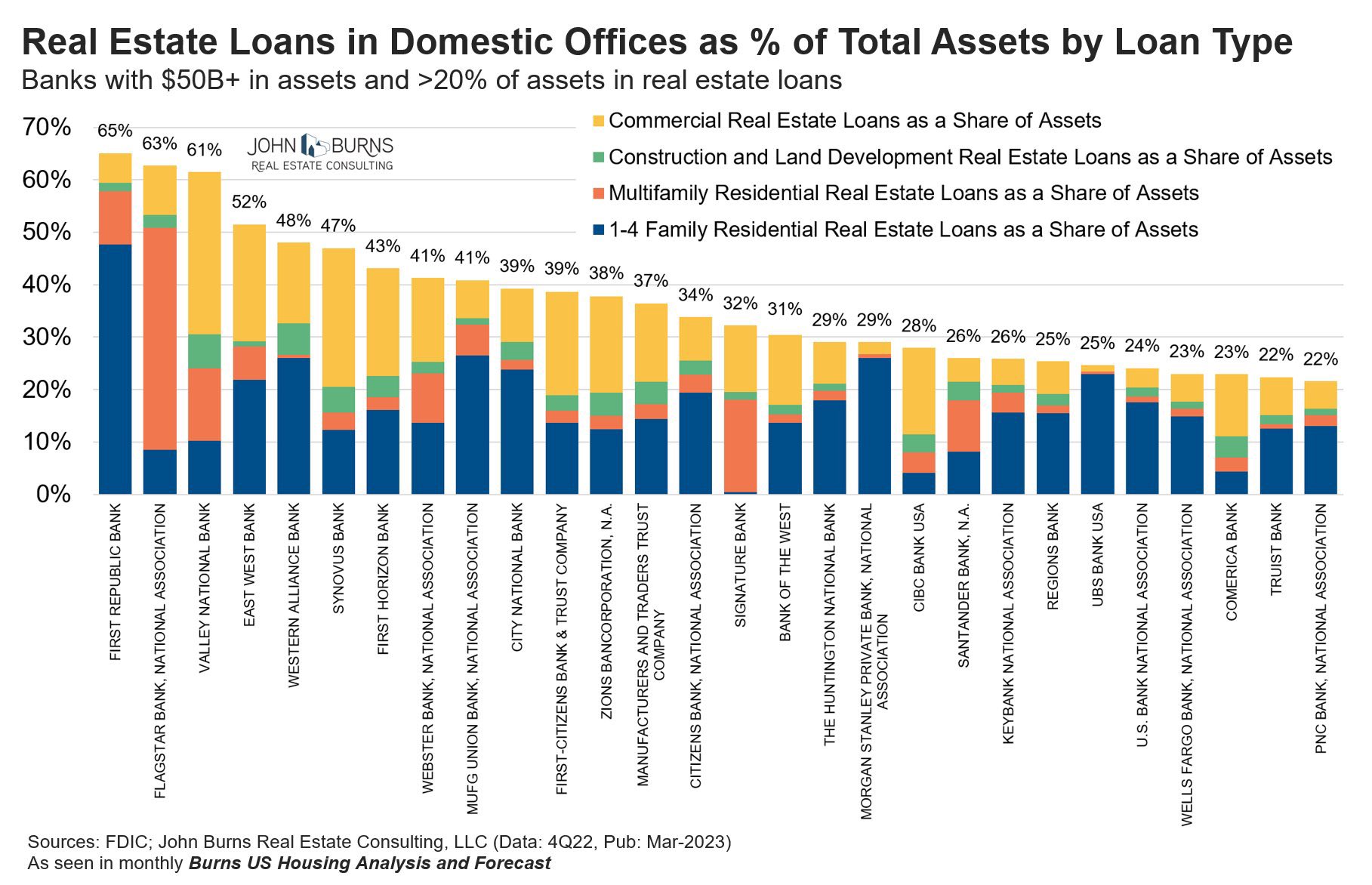

What to do with all this money? Banks used it to invest in relatively safe treasury bills and agency mortgage-backed securities and lent it to commercial real estate projects. As Jim Russel pointed out, smaller banks, in particular, developed a growing appetite for loans to finance the acquisition of assets like office buildings and warehouses. By the beginning of 2021, smaller banks provided about 70% of all commercial real estate financing.

As Arpit Gupta points out, smaller banks stepped up their commercial landing because larger banks pulled back, but also because smaller regional banks have inherent information advantages: they know local markets better and, at least in theory, are in a better position to assess the quality of the projects they finance.

And so, smaller banks loaded their balance sheets with residential and commercial real estate. Some banks have as much as 30% of their assets in outstanding loans. This probably seemed reasonable to people who expected offices to "return to normal" once vaccination rates got high enough. Low-interest rates also helped prop up the valuation of office buildings, setting high multiples for their income. And rental income in 2021 were still robust since most leases weren't up for renewal yet — even though offices were mostly empty.

But stimulus checks, high savings, and low-interest rates didn't last forever. As inflation intensified, people tapped their bank accounts to make ends meet, and the Fed raised rates to cool down the economy.

On the bright side, many people returned to the office, but not enough. In response, some of the largest property owners started defaulting on their loans and returning buildings to the bank. Last month, Columbia Property Trust defaulted on a $1.72 billion loan backed by office towers. Brookfield Assets Management defaulted on a $750 million loan for a pair of office buildings earlier. And many other landlords are contemplating similar moves.

This leaves the bank in a bind. What seemed to banks like conservative investments in 2021 is now a ticking time bomb that threatens to destabilize their business. The valuations of many office buildings have dropped or will likely drop considerably. And government bonds are much cheaper now than they were two years ago.

Most office buildings will be ok, and some will do better than ever. But that doesn't solve the problem. To maximize their value, owners must introduce new services and amenities and embrace flexibility. This costs money. And more importantly, it changes the nature of the asset. Offices are no longer a "monopoly" asset with stable, bond-like returns. Instead, they are more like a retail or hospitality business — with more volatile income and shorter-term commitments from customers.

The challenge for banks is not that offices are worthless but that they are riskier than they assumed. Those who read my 2019 book, Rethinking Real Estate, would have been better prepared. As I wrote:

Customers are becoming more demanding and less willing or able to make long-term commitments. Offering differentiated services and flexibility will make it possible to extract more value from real estate assets. But service revenue and less traditional leases will make income less predictable and less bond-like. In a sense, many properties will no longer be assets in themselves but will serve as inputs and components of other operating businesses. This might make buildings more valuable than ever, but it will also affect their ability to fill their current role within institutional portfolios.

As their operational intensity increases, the financial performance of office, multifamily, and industrial assets might become more correlated with other businesses in the overall economy.... A growing correlation with other asset classes will affect real estate’s position as an alternative asset class. Institutional allocations will have to be adjusted to reflect this change.

For real estate owners, it's not all bad. Some buildings will be worth more than ever, particularly those that are operated in a manner that enhances flexibility and service and integrates them into local or international networks — just like the best hotels. But for some banks, the effect of remote work on offices might cause more damage and weaken their already weakened position.

As for the rest of us — even if you missed out on the insights from 2019, there are always new ones. You can start reading my next book, After Office, to consider the broader consequences of what's happening right now.

Thank you for reading.

Best,

Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.