Midwit-Adjacent Investing

Looking for a good investment? Find it on the lower slopes of the midwit curve.

The best investments I made over the past decade have several things in common. These include Bitcoin, Ethereum, Solana, Nvidia, Palantir, and, more recently, the nuclear energy firm Oklo.

These investments represent a thesis that might be of interest to my readers. This is not investment advice. I do not mean this merely as a legal disclaimer but a statement of intent: The thesis is interesting because it says something about the time we live in. Beyond that, I do not know and cannot promise if it can help you make money in the future. It might just be a rationalization on the part of a man who took too much risk and got lucky.

In any case, the investment criteria are as follows:

- Exponential growth potential.

- Strong memetic potential.

- Small market capitalization compared to other — older — companies in the same space. Specifically, an indication of the possibility to grow 10X in value over 5 years. Note, I do not need the investment to have a high probability of growing like this, but a decent probability above zero — let's say 20%.

- Proven demand, but early. Meaning, I do not dive into financial reports, but I am looking for an indication from the market that there is actual demand for whatever the company or project is offering.

- Easy to invest in. Meaning: They are available for anyone to buy or sell (unlike some types of financial products and private assets).

- Size the position as a bet that could go to zero without affecting my lifestyle or my ability to continue to make 2-3 similar bets per year.

Of these points, the second one about memetic potential is the most important one. The others are there to make the overall math work (more on the math in a moment).

Memetic potential means investments that:

- Fit into a theme that could become super hyped in the coming years; and

- Are likely to become emblematic of that theme.

For example, In the middle of 2022, AI was a theme that had a decent likelihood of becoming super-hyped. It is the kind of topic that Jim Cramer could tout on MSNBC and that Time magazine could feature on its cover. If such a hype wave materialized, Nvidia, as a publicly-traded company and the primary provider of chips to the leading AI labs, had a strong chance of becoming the go-to stock for mainstream investors that want to "get in on AI." Note that the general public could not invest in OpenAI directly because it was not publicly traded, so Nvidia was the closest possible proxy.

The same was true for Palantir and defense technology (and AI), for Oklo with nuclear energy, for Bitcoin and Ethereum with crypto, and for Solana for the second wave of crypto. Each of these was not just part of a theme that could get hot; they also had the potential to become emblematic of that theme. Meaning that any journalist writing a story about AI/crypto/defense/nuclear energy was very likely to mention these stocks — and promote them to mainstream investors.

How does one find such investments?

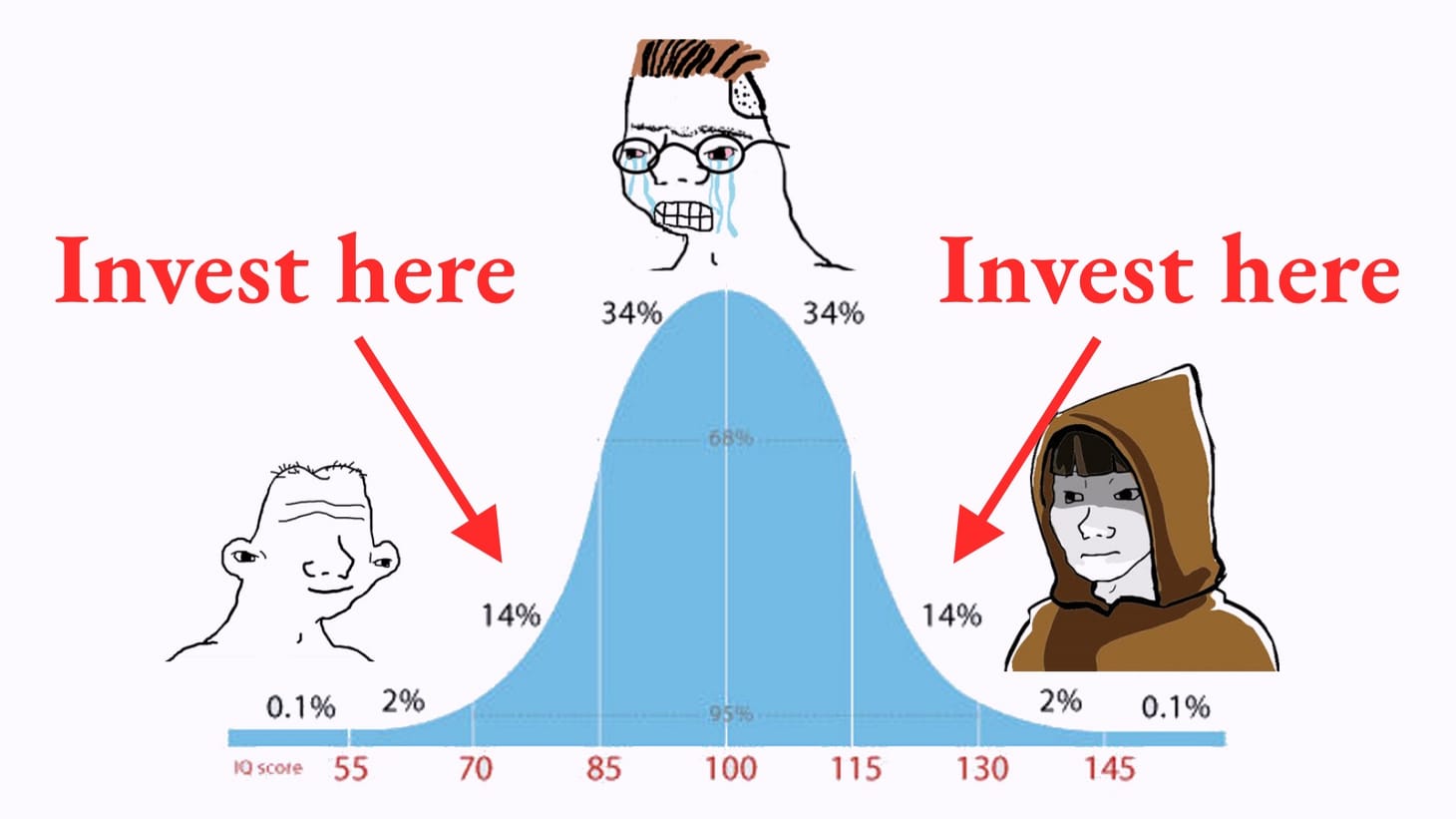

On the lower slopes of the midwit curve. What?! For those of you not familiar, the midwit curve is a meme that humorously illustrates how people at different levels of understanding often approach the same idea. It shows how those on the low and high ends of the curve often arrive at the same conclusion, while those in the middle tend to overthink it and miss the point.

Here's an example of this meme on the topic of health:

As you can see, the "simpleton" and the "wizard" share the same idea, while the "educated" fellow in the middle overthinks it. Many ideas — including investment ideas — have a tendency to begin on either side of the curve and ultimately make their way to the center. They begin among the simpletons and wizards and then find their way into the mainstream.

The most extreme example of this dynamic is crypto. For years, it was a favorite of self-proclaimed "degenerates" on Reddit and Twitter and of "mad" geniuses like Vitalik Buterin and Peter Thiel. Now, Bitcoin is worth over $100,000, the President of the United States has launched his own crypto token, Wall Street is embracing blockchain products, and the government is contemplating a strategic cryptocurrency reserve.

AI is another great example. Even before ChatGPT was launched, there were clear signs something big was coming. And even after ChatGPT went live, most people didn’t get too excited. But the “wizards” were excited—and so were many “simpletons” who shared their ChatGPT-generated jokes and homework assignments on Twitter and Reddit.

Even today, there are people on LinkedIn who claim generative AI is useless and stupid. But the big wave is already here, and the world’s largest investors and governments are pouring money into AI models, data centers, and the necessary energy plants. Ironically, the “midwit” takes on LinkedIn indicate that the wave still hasn’t fully conquered the mainstream—suggesting more laggards will likely pile in.

Finding investment ideas on the lower slopes of the midwit curve means finding the ideas that are trending on either (or both) sides of the curve but have yet to enter the mainstream. To do this, you need to spend time on Twitter, Reddit, and other places where "degenerates" and "wizards" converse.

Of course, not every idea ends up going mainstream. This is what the investment criteria I listed are for. The investment idea has to have exponential growth potential, some proven demand, and very strong upside potential. The strong upside is there to make up for the risk.

So, that's what I call Midwit-Adjacent Investing: investing in stuff that is not yet mainstream but is far enough along either side of the curve to show true mainstream potential. It is adjacent — moving from the edges towards the center, but not yet at the center.

It is also worth mentioning what kind of investments I avoid. I am best known for predicting the current office crisis and for analyzing real estate markets more broadly. But while I have some exposure to real estate, most of my investments are in tech.

This brings us to another thesis that is related to the first one. We live in an era of massive investments in technology. The beauty of tech investments is that they are both high-risk in themselves and they make all other assets riskier by destabilizing existing assumptions across the economy. For example, the current AI boom is not just risky in itself, but it threatens to destabilize many other investment assets, such as office REITs, financial services firms, defense contractors, and more.

So, massive tech investments increase the risk (uncertainty) for the whole market. But while tech investments can produce exponential returns, most other assets cannot. This means that, on average, all investors currently bear more risk, but only tech investors have the upside potential to make up for it.

In more technical terms, it means that the growth of tech investment makes most other assets less attractive in terms of risk-adjusted returns. This doesn't mean you should only invest in tech or that tech stocks will keep climbing up. But if you’re going to take on the extra risk that tech hype brings, make sure it’s a bet with exponential upside—and place that bet before the mainstream piles in.

This is not investment advice, just food for thought and discussion. What’s your take?

Have a great weekend,

🎤 How will AI reshape cities, offices, and markets? My speaking schedule for the spring is filling up. Visit my speaker profile and get in touch to learn more.

Old/New by Dror Poleg Newsletter

Join the newsletter to receive the latest updates in your inbox.